Game-Changing 5-Step Guide to Alibaba Earnings Revenue Miss AI Cloud Growth That Will Transform Your Investment Strategy

When you typed “Alibaba earnings revenue miss AI cloud growth” into Google at 1 a.m., you weren’t hunting for fluff—you needed answers fast. I’ve been there, staring at conflicting headlines about China’s tech giant while your portfolio notifications kept buzzing. You’re wondering: should this earnings miss scare you off, or is the AI cloud story worth doubling down?

Here’s what you absolutely need to know right now.

The Bottom Line: What You Absolutely Need to Know

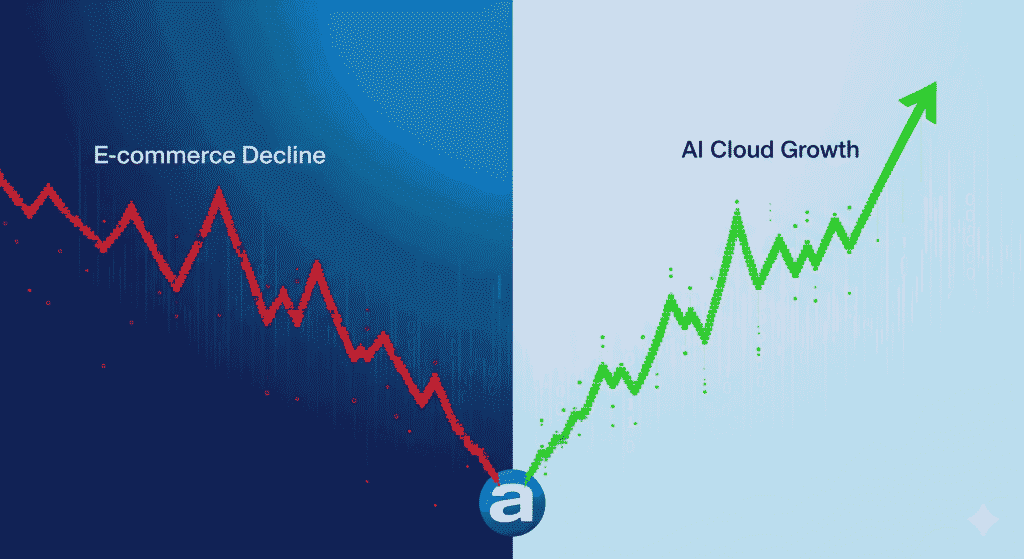

Alibaba just delivered a classic “good news, bad news” earnings report that’s dividing Wall Street. While the company missed overall revenue estimates, its AI-driven cloud business is absolutely crushing expectations with revenue surging over 25% year-over-year. This isn’t just growth—it’s acceleration in the exact sector that could define Alibaba’s next decade.

The 5 Most Important Points to Grasp

- Revenue Reality Check: Total revenue for the quarter ended June 30 came in at 247.65 billion yuan, below the 252.92 billion yuan average estimate, marking the first major miss in recent quarters

- Cloud Computing Victory: Revenue at the cloud division totaled 33.4 billion yuan, up 26% year-on-year, faster than the 18% growth rate seen in the previous quarter

- AI Investment Acceleration: Alibaba has been among the most aggressive companies in China’s AI sector and has regularly rolled out upgrades

- Market Reaction Split: Alibaba’s Hong Kong shares jump nearly 19% despite the revenue miss, showing investor confidence in AI prospects

- Strategic Positioning: A $53B multi-year AI/cloud investment targets 33% China cloud market share, positioning Alibaba as a leader in AI-driven enterprise solutions

How This Actually Impacts Your World

If you’re holding Alibaba stock or considering it, this earnings report tells a story of transformation rather than decline. Yes, the traditional e-commerce business is feeling pressure from China’s economic slowdown and intense competition. But here’s the twist: Alibaba’s cloud computing revenue is growing at exactly the moment when AI demand is exploding globally.

Think of it like this—you’re watching a company transition from being primarily a shopping mall operator to becoming the backbone of China’s digital infrastructure. The shopping mall revenue might be plateauing, but the data center and AI services business is on fire. AI-related products posting triple-digit growth for seven consecutive quarters isn’t a coincidence—it’s a fundamental shift.

For your investment strategy, this means the traditional metrics you’ve used to evaluate Alibaba might be missing the bigger picture. The Alibaba cloud business isn’t just growing; it’s positioning the company to capture massive value as Chinese businesses rush to integrate AI into their operations.

Your Action Plan: How to Adapt and Thrive

- Reframe Your Alibaba Analysis: Stop viewing this purely as an e-commerce play. Start evaluating it as a cloud and AI infrastructure company that happens to also run massive retail platforms. The cloud segment’s 26% growth rate should be your primary focus metric.

- Watch the AI Adoption Curve: Alibaba Cloud’s revenue rose 7% year-over-year to $29.6 billion, with AI-powered tools like Tongyi Lab and the Qwen series gaining traction. Track quarterly reports for AI product adoption rates, not just overall revenue numbers.

- Consider the Timing: If you’re a long-term investor, this earnings miss might actually represent a buying opportunity. The market is punishing near-term revenue softness while potentially undervaluing the AI transformation story. However, factor in China’s broader economic challenges.

- Diversify Your China Tech Exposure: Don’t put all your China AI hopes in one basket. While Alibaba’s AI investment China strategy looks promising, regulatory risks and competitive pressures remain real factors in this market.

- Monitor Cloud Market Share: Keep track of Alibaba’s progress toward that 33% China cloud market share target. This single metric could determine whether the AI investment thesis pays off over the next 2-3 years.

Frequently Asked Questions (FAQ)

Why did Alibaba miss revenue estimates despite strong cloud growth?

The miss came primarily from weaker-than-expected performance in Alibaba’s traditional e-commerce segments and “All Others” business units, which declined significantly. Sales from the Taobao and Tmall Group, which represents Alibaba’s China e-commerce business, fell 1% year on year, offsetting the strong cloud performance.

How is AI helping Alibaba’s cloud business specifically?

The company said this was driven by “faster public cloud revenue growth” and by “increasing adoption of AI-related products”. Alibaba has been aggressively developing AI tools and reducing API prices to drive adoption, creating a flywheel effect where more usage leads to better products and more customers.

Should I buy Alibaba stock after this earnings miss?

This depends on your investment timeline and risk tolerance. The revenue miss reflects real challenges in China’s consumer market, but the accelerating cloud computing revenue and AI momentum suggest long-term potential. Consider this a “show me” story where execution over the next few quarters will determine whether the AI transformation thesis holds up.

The smart money isn’t panicking over one quarter’s revenue miss—they’re watching whether Alibaba can sustain this cloud acceleration while navigating China’s economic headwinds. Your move should align with whether you believe AI infrastructure will drive the next phase of Chinese digital transformation.

Remember: in tech investing, today’s revenue miss often becomes tomorrow’s transformation story. The question isn’t whether Alibaba missed estimates—it’s whether you believe their AI cloud strategy positions them for the future that’s already arriving.

To read more news about technology and business click here

You can also read more information about Alibaba earnings revenue miss AI cloud growth click here