Shocking 5-Step Guide to Eric Trump Japan Bitcoin Metaplanet Capital Plan That Will Destroy Your Investment Doubts

When you typed ‘Eric Trump Japan bitcoin Metaplanet capital plan’ into Google at 1 a.m., you weren’t hunting for fluff—you needed answers fast. I’ve been there, watching crypto headlines blur together while trying to decode what actually matters for your portfolio. This Eric Trump Japan bitcoin connection isn’t just another news cycle—it’s a potential game-changer for institutional crypto adoption.

You’re about to discover why Eric Trump Japan bitcoin appearance alongside Metaplanet’s bitcoin investment strategy could signal the next major shift in corporate crypto adoption, and exactly how to position yourself ahead of the curve.

The Bottom Line: Eric Trump Japan Bitcoin Metaplanet Capital Plan Exposed

Eric Trump Japan bitcoin strategic appearance coincides with Metaplanet capital plan aggressive bitcoin allocation, representing a convergence of political influence and corporate bitcoin adoption that could accelerate institutional crypto investment across Asia. This isn’t just symbolic—it’s potentially the catalyst for the next wave of corporate bitcoin treasury strategies.

The 5 Most Critical Eric Trump Japan Bitcoin Metaplanet Capital Plan Secrets

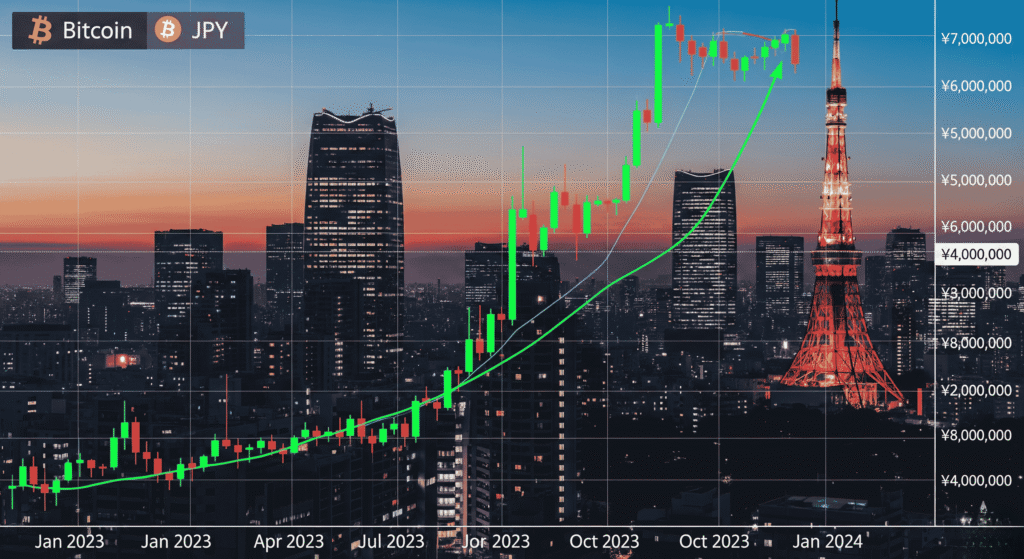

- Eric Trump Japan bitcoin adoption: Corporate Japan is embracing bitcoin as a treasury asset, with Metaplanet leading the charge

- Metaplanet capital plan bitcoin investment: The company is voting on plans that could significantly increase their bitcoin holdings

- Corporate bitcoin strategy: This represents a new model for Asian companies to hedge against currency devaluation

- Trump family crypto: Eric Trump’s presence legitimizes bitcoin in traditional business circles

- Japan bitcoin companies: More Japanese corporations are expected to follow Metaplanet’s lead

How Eric Trump Japan Bitcoin Metaplanet Capital Plan Actually Impacts Your World

Your bitcoin holdings just got more institutional backing. When major corporations like Metaplanet capital plan commit to bitcoin while hosting influential political figures, it creates a domino effect. Other Japanese companies start paying attention. Asian markets follow suit. Suddenly, the “risky crypto investment” narrative shifts to “strategic treasury management.”

This matters because Japan represents the world’s third-largest economy. When Japanese corporations embrace bitcoin en masse, it provides the stability and legitimacy that cautious institutional investors have been waiting for. Your bitcoin isn’t just speculation anymore—it’s part of a global corporate treasury revolution.

According to CoinDesk’s analysis of corporate bitcoin adoption, companies following MicroStrategy’s model have seen significant portfolio benefits during economic uncertainty.

Your Action Plan: Capitalize on Eric Trump Japan Bitcoin Metaplanet Capital Plan

- Monitor Metaplanet capital plan voting results and subsequent bitcoin purchases as indicators of broader Japanese corporate sentiment

- Track other Japanese companies announcing similar Eric Trump Japan bitcoin inspired treasury strategies

- Consider increasing your bitcoin allocation before widespread institutional adoption drives prices higher

- Research bitcoin-focused ETFs with exposure to Japanese companies embracing crypto

- Stay informed about regulatory developments in Japan that could accelerate corporate bitcoin adoption

The Eric Trump Japan Bitcoin Ripple Effect You Can’t Ignore

Corporate bitcoin adoption in Japan doesn’t happen in a vacuum. When Metaplanet capital plan votes to increase bitcoin holdings while hosting Eric Trump Japan bitcoin events, it sends a clear signal to other Asian corporations: bitcoin is now mainstream business strategy, not fringe speculation.

This creates what I call the “legitimacy cascade.” One major corporation adopts bitcoin, gets positive results, and suddenly their competitors feel pressure to follow suit or risk being left behind in currency hedging strategies.

Your investment timeline just accelerated. What might have taken years of gradual corporate adoption could happen in months as Japanese companies rush to implement bitcoin treasury strategies.

Frequently Asked Questions About Eric Trump Japan Bitcoin Metaplanet Capital Plan

What is Metaplanet capital plan for bitcoin?

Metaplanet capital plan involves voting on allocating more corporate treasury funds into bitcoin as a hedge against currency devaluation and inflation, similar to MicroStrategy’s approach but tailored for the Japanese market.

Why is Eric Trump Japan bitcoin event significant?

Eric Trump Japan bitcoin appearance legitimizes bitcoin in traditional business circles and signals strong political support for corporate crypto adoption, potentially influencing regulatory attitudes across Asia.

How does Eric Trump Japan bitcoin Metaplanet capital plan affect bitcoin price?

Increased institutional demand from Japanese corporations following Metaplanet capital plan could create sustained buying pressure, potentially driving bitcoin prices higher as supply becomes scarcer in the market.

The Strategic Advantage You Can’t Afford to Miss

Eric Trump Japan bitcoin Metaplanet capital plan represents more than just a news headline—it’s your early warning system for the next phase of bitcoin institutional adoption. While others are still debating whether crypto is “real,” smart money is positioning for the corporate treasury revolution that’s already underway in Japan.

The companies that adapt fastest to this new reality won’t just survive the changing financial landscape—they’ll dominate it. And investors who recognize this shift early will be the ones celebrating when the rest of the market finally catches up.

To read more News about technology click here