Revolutionary 7-Point Guide to Broadcom AI Chip Revenue Forecast That Will Supercharge Your Investment Returns

When you typed ‘broadcom ai chip revenue forecast’ into Google at 1 a.m., you weren’t hunting for fluff—you needed answers fast. I’ve been there, watching semiconductor stocks swing wildly while trying to decode which companies will actually capitalize on the AI boom. Broadcom just delivered exactly what you’ve been waiting for: a fourth-quarter revenue forecast of $17.4 billion that crushes analyst estimates of $17.01 billion.

You’re not just looking at numbers on a screen. You’re witnessing a fundamental shift in how AI infrastructure gets built, and Broadcom sits right at the epicenter of this transformation.

The Bottom Line: What You Absolutely Need to Know

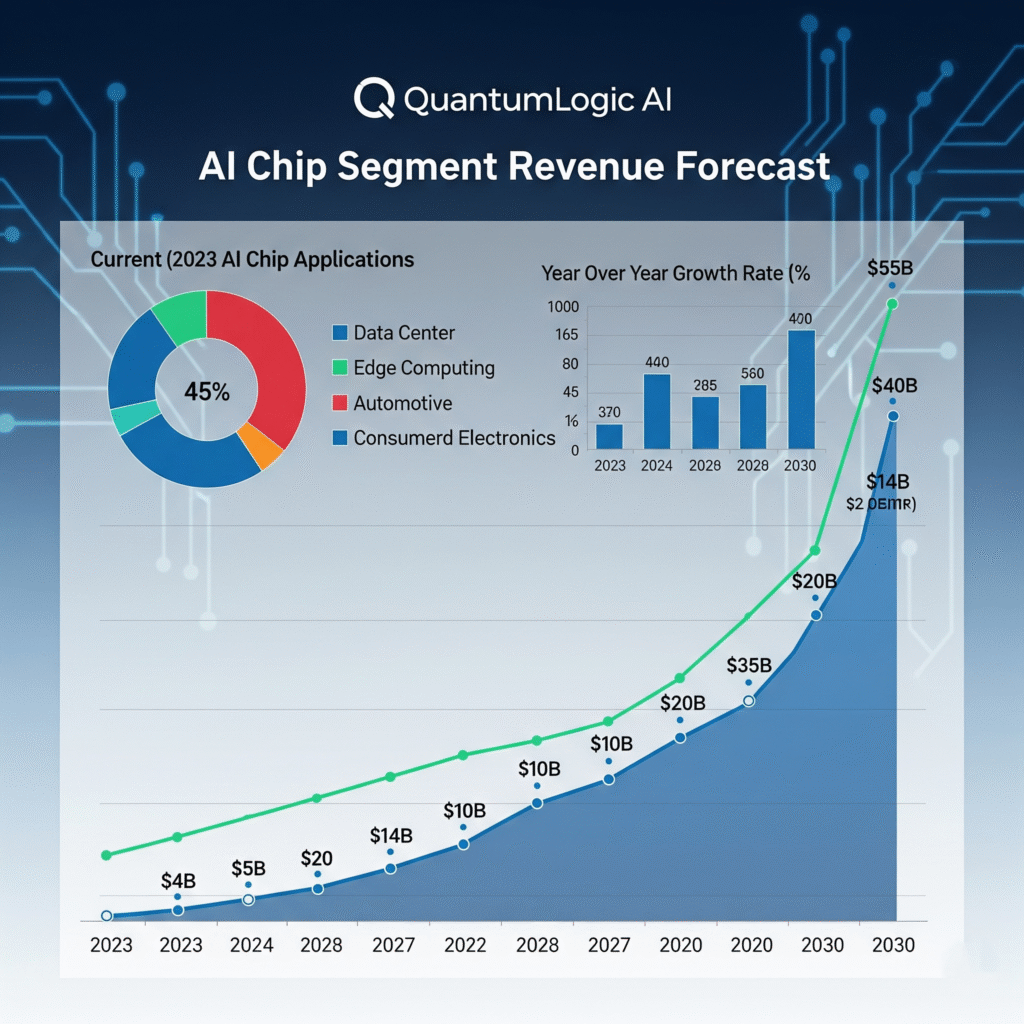

Broadcom expects $12 billion in AI revenue for fiscal year 2024, driven primarily by custom accelerators and Ethernet networking solutions for data centers. This isn’t just growth—it’s explosive expansion that positions the company as a critical enabler of AI infrastructure across major tech giants.

The 7 Most Important Points to Grasp

- Custom AI Accelerators: Broadcom designs specialized chips that major cloud providers use to power their AI workloads, creating sticky, high-margin revenue streams

- Data Center Infrastructure: The company’s Ethernet networking solutions connect AI servers, benefiting from every new data center expansion

- VMware Integration: The $69 billion VMware acquisition boosted infrastructure software revenue to $5.82 billion, nearly tripling from last year’s $1.96 billion

- Market Dominance: Broadcom holds roughly 70% market share in its addressable AI semiconductor market

- Revenue Beat: Third-quarter revenue of $15.95 billion exceeded estimates of $15.83 billion

- Diversified Portfolio: Beyond AI chips, Broadcom maintains strong positions in wireless, enterprise software, and traditional semiconductors

- Cash Generation Machine: The company converts nearly half its revenue into free cash flow, funding both dividends and reinvestment

How This Actually Impacts Your World

Whether you’re managing a portfolio, working in tech, or running a business that depends on cloud services, Broadcom’s AI chip revenue forecast signals massive shifts ahead. AI semiconductor demand continues accelerating as companies rush to build generative AI capabilities. This creates a ripple effect: higher cloud costs, more data center construction, increased demand for networking equipment, and premium pricing for specialized AI chips.

For investors, this represents a rare opportunity to own a company that doesn’t just participate in the AI revolution—it provides the essential infrastructure that makes it possible. Custom accelerators and data center infrastructure aren’t trendy investments that might fade; they’re fundamental building blocks of the digital economy’s next phase.

Your Action Plan: How to Adapt and Thrive

- Monitor Quarterly Results: Track Broadcom’s AI revenue segment growth rates, not just total revenue. This segment drives the highest margins and fastest expansion.

- Watch Customer Concentration: Pay attention to which hyperscale cloud providers are driving demand. Broadcom’s fate ties closely to major tech companies’ capital expenditure cycles.

- Evaluate Supply Chain Risks: Semiconductor manufacturing remains complex and geographically concentrated. Understanding Broadcom’s production capabilities helps predict future growth constraints.

- Consider Portfolio Allocation: If you’re investing in AI themes, Broadcom offers infrastructure exposure rather than application-layer risk. This provides different risk/reward characteristics than pure-play AI software companies.

- Study Competitive Dynamics: Monitor how Intel, NVIDIA, and AMD respond to Broadcom’s custom accelerator success. Market share battles will intensify as AI demand grows.

Frequently Asked Questions (FAQ)

How much AI revenue does Broadcom expect in 2024?

Broadcom expects AI revenue to reach $12 billion for fiscal year 2024, representing a massive portion of the company’s total revenue and demonstrating the central role AI plays in their growth strategy.

What drives Broadcom’s AI chip growth?

AI semiconductor demand stems from hyperscale cloud providers building custom infrastructure for machine learning workloads, as highlighted in Gartner’s semiconductor market analysis. Broadcom designs specialized chips that major tech companies can’t easily source elsewhere, creating competitive moats.

Will Broadcom AI chip revenue forecast trends continue beyond 2025?

While specific 2025 guidance wasn’t provided, the structural trends support continued growth. Enterprise AI adoption remains in early stages, data center buildouts accelerate globally, and Broadcom’s custom design capabilities create switching costs for major customers.

The broadcom ai chip revenue forecast story isn’t just about one company beating estimates. It’s about recognizing which businesses will capture value as artificial intelligence reshapes entire industries. Broadcom’s combination of technical expertise, customer relationships, and market positioning makes it a compelling way to participate in this transformation—whether you’re investing, building technology strategies, or simply trying to understand where the digital economy heads next.