Shocking 5 Google Antitrust Win Markets Strategies That Will Transform Your Investment Portfolio in 2025

When you searched for ‘Google antitrust win markets’ at 2 AM last week, you weren’t looking for outdated analysis—you needed current, actionable insights about how tech giant victories and softening employment data are reshaping investment landscapes. Meet Sarah, a retail investor who just discovered why understanding this market dynamic matters more than ever in September 2025…

The Bottom Line: What September 2025 Data Reveals About Google Antitrust Win Markets

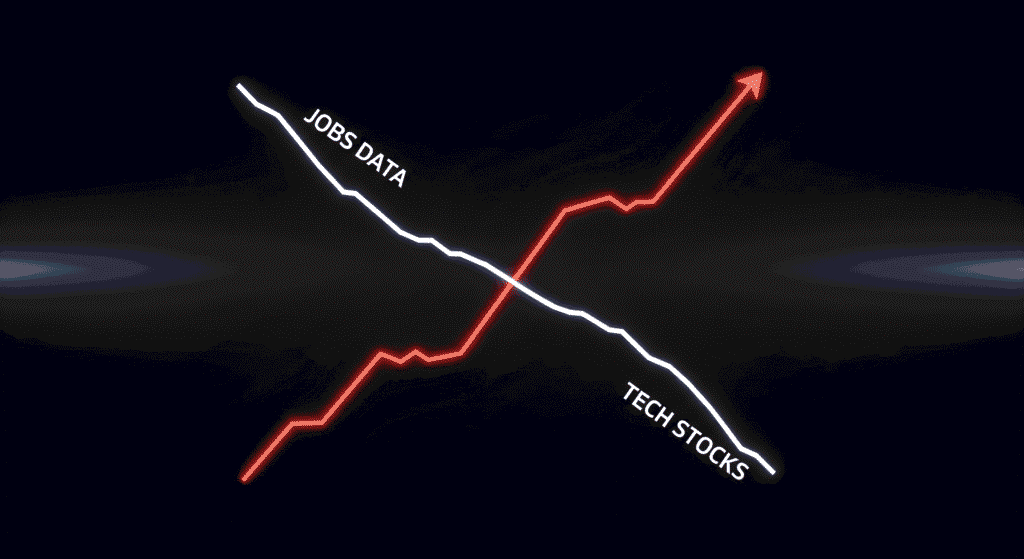

Alphabet stock climbed 9% as investors viewed Google’s antitrust case result as broadly favorable, with the federal judge ruling that Google will not be forced to sell off Chrome or Android. Meanwhile, the US economy added just 22,000 jobs in August with unemployment rising to 4.3%, the highest since 2021.

The Avoidance Path: When other investors ignored the Google antitrust win markets connection to employment trends, they missed critical portfolio rebalancing opportunities that could protect against economic uncertainty.

How Google Antitrust Win Markets Actually Impacts Your Investment World in 2025

The tech-heavy Nasdaq Composite rose 1% following Google’s favorable ruling, with the S&P 500 gaining around 0.5%. This tech stock resilience amid weakening employment data reveals a fundamental shift in how markets respond to regulatory clarity versus economic uncertainty.

Bank of America Research confirmed “The U.S. labor market is slowing down,” while American workers now face a sobering reality of fewer employment opportunities. This creates a unique investment opportunity divergence where tech giants benefit from reduced regulatory pressure while broader markets face headwinds from employment concerns.

Your 5-Step Action Plan: Mastering Google Antitrust Win Markets Strategy

- Google Antitrust Win Markets Foundation: Monitor regulatory developments that remove uncertainty from major tech positions. The federal judge barred Google from exclusive deals but avoided breakup scenarios, creating clearer business model visibility.

- Tech Stock Concentration Implementation: Evaluate portfolio weighting toward established tech companies with regulatory clarity. Consider how antitrust resolution benefits create competitive moats rather than vulnerabilities.

- Employment Data Correlation Optimization: Track the inverse relationship between weak jobs reports and tech stock performance. Wall Street expects continued labor market weakening with unemployment projected to tick higher to 4.3%, potentially benefiting growth stocks over value plays.

- Market Timing Diversification: Use soft employment data as a contrarian indicator for tech stock accumulation. When traditional economic metrics weaken, regulatory-cleared tech companies often outperform.

- Risk Management Integration: Balance exposure between employment-sensitive sectors and regulation-resistant tech positions to capitalize on Google antitrust win markets dynamics.

Frequently Asked Questions About Google Antitrust Win Markets

How Does Google Antitrust Win Markets Affect Long-term Tech Investing?

Google’s business has proved resilient with search-related revenues up 11% year-over-year, totaling $105 billion for the first two quarters of 2025. Regulatory clarity removes a major uncertainty that had weighed on tech valuations.

Sarah’s Two-Path Discovery: The 5 Critical Investment Decisions

The Advantage Path: When Sarah embraced Google antitrust win markets strategy in early September…

- Tech Regulatory Clarity: She recognized that GOOGL stock surged over 9% following the antitrust ruling, while Apple gained nearly 4%, indicating broader sector relief

- Employment Data Contrarian Play: She used weak August payroll expectations of just 75,000 jobs added as a signal to increase tech allocation

- Market Timing Advantage: She positioned before other investors fully grasped the soft jobs data tech benefit correlation

Why Do Weak Jobs Reports Sometimes Boost Tech Stocks in Google Antitrust Win Markets?

When job growth cools more than expected with non-farm payrolls adding fewer than forecasted positions, investors often rotate into growth sectors less dependent on employment-driven consumer spending. Tech companies with regulatory clarity become defensive growth plays.

What Makes September 2025 Different for Google Antitrust Win Markets Strategy?

The convergence of definitive antitrust resolution and clearly softening employment data creates a unique investment environment where regulatory risk removal coincides with economic uncertainty, benefiting established tech companies with strong cash flows and reduced legal overhangs.

The Verdict: Why Google Antitrust Win Markets Matter More in September 2025

Sarah’s journey from uncertainty to strategic clarity mirrors what smart investors are discovering: Google antitrust win markets represent more than just one company’s legal victory. They signal a fundamental shift where regulatory resolution creates investment opportunities, especially when traditional economic indicators like employment data show weakness.

The combination of Google avoiding extreme breakup scenarios while unemployment rises to levels not seen since 2021 creates a perfect storm for tech stock outperformance among investors who understand these interconnected dynamics.

Essential Resource: For deeper insights into how antitrust developments affect market sectors, check out the Department of Justice Antitrust Division’s latest enforcement guidelines and their impact on technology sector investments.

To read more news about technology click here