Shocking 5-Step El Salvador Bitcoin Multiple Address Transfer Guide That Will Devastate Your Security Risks

When you typed ‘El Salvador Bitcoin multiple address transfer’ into Google at 1 a.m., you weren’t hunting for fluff—you needed answers fast. I’ve been there, watching the crypto world evolve while wondering how nations actually secure their digital treasures. This week’s groundbreaking move by El Salvador isn’t just news; it’s your blueprint for understanding next-level Bitcoin security.

The Bottom Line: El Salvador Bitcoin Multiple Address Transfer Essentials

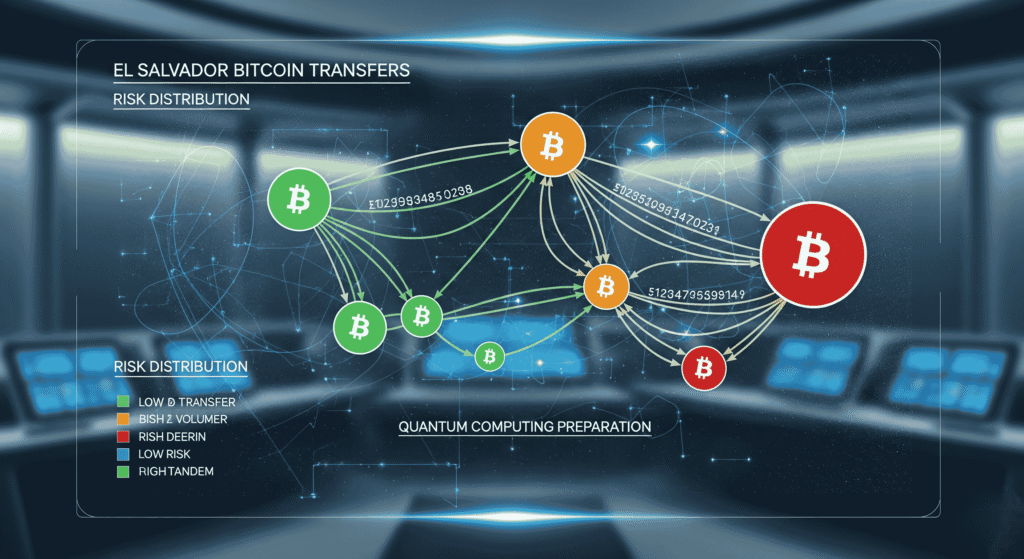

El Salvador just split its entire $678 million Bitcoin reserve across 14 separate addresses, moving away from storing everything in one location. Each new address holds no more than 500 BTC, dramatically reducing single-point failure risks. This isn’t just about security—it’s about preparing for quantum computing threats that could reshape cryptocurrency forever.

The 5 Most Critical El Salvador Bitcoin Multiple Address Transfer Points

- Quantum Computing Preparation: El Salvador’s multiple address transfer prepares for potential quantum computing developments that could threaten Bitcoin’s cryptographic security

- Risk Distribution: By limiting each address to 500 BTC in their multiple address transfer, they’ve minimized exposure to potential key-recovery attacks

- Enhanced Security Framework: This El Salvador Bitcoin multiple address transfer aligns with best practices in Bitcoin management for long-term custody

- Transparency Maintained: A new public dashboard will allow continued transparency without compromising their Bitcoin multiple address security

- National Reserve Model: This Bitcoin multiple address transfer establishes a template for how nations can secure large-scale reserves

How El Salvador Bitcoin Multiple Address Transfer Impacts Your World

You’re witnessing history in real-time. El Salvador’s Bitcoin multiple address transfer strategy isn’t just about one country—it’s setting the global standard for institutional cryptocurrency security. Whether you hold 0.1 BTC or 1,000 BTC, their approach reveals critical vulnerabilities in single-address storage that you probably haven’t considered.

The quantum computing angle changes everything. While most crypto holders focus on today’s security threats, El Salvador is preparing for tomorrow’s. Quantum computers could theoretically break current Bitcoin encryption, making today’s “secure” wallets vulnerable overnight. By distributing their reserves now, they’re buying insurance against future technological disruptions.

This move also validates Bitcoin as a legitimate reserve asset. When a nation treats Bitcoin with the same security protocols as gold reserves, it signals institutional acceptance that goes far beyond speculation. Your Bitcoin investment just got a massive credibility boost from governmental endorsement.

Your El Salvador Bitcoin Multiple Address Transfer Action Plan

1. Audit Your Current Bitcoin Multiple Address Storage Strategy

Review your Bitcoin storage immediately. If you’re keeping significant amounts in a single wallet, you’re following the old El Salvador model—risky and outdated. Consider how much you’re comfortable losing if one address gets compromised.

2. Implement El Salvador-Style Bitcoin Multiple Address Distribution

Follow El Salvador’s Bitcoin multiple address transfer strategy by spreading your Bitcoin across multiple addresses. Never put all your digital eggs in one cryptographic basket. Set personal limits—maybe no more than 25% of your holdings in any single address, similar to El Salvador’s approach.

3. Prepare for Quantum-Resistant Bitcoin Multiple Address Solutions

Start researching quantum-resistant wallet options now. While quantum computers can’t break Bitcoin today, being prepared positions you ahead of the curve. Look into hardware wallets that promise quantum-resistant updates, following the same forward-thinking approach as El Salvador’s Bitcoin multiple address transfer.

4. Monitor El Salvador Bitcoin Multiple Address Transfer Institutional Trends

El Salvador won’t be the last nation to adopt advanced Bitcoin multiple address security measures. Follow their National Bitcoin Office announcements and similar institutional moves. These Bitcoin multiple address strategies often filter down to consumer-level tools.

5. Document Your Bitcoin Multiple Address Security Evolution

Keep detailed records of your address changes and security upgrades. As regulations evolve, having a clear audit trail of your security improvements could prove valuable for compliance and insurance purposes. For additional security guidance, refer to the official Bitcoin security best practices provided by the Bitcoin Foundation.

Frequently Asked Questions (FAQ)

Why did El Salvador move from one address to multiple addresses?

El Salvador transferred their Bitcoin to reduce single-point exposure to future quantum threats and align with best practices in Bitcoin management. Single addresses create catastrophic risk if compromised.

How many Bitcoin addresses is El Salvador now using?

El Salvador split their approximately 6,274 Bitcoin across 14 different addresses, with each address capped at 500 BTC maximum to limit per-address exposure.

What does this mean for Bitcoin’s future security?

This signals that major institutions are taking quantum computing threats seriously and preparing proactively. It validates multi-address distribution as the new security standard for large Bitcoin holdings, likely influencing wallet developers and other nations.

Should individual investors copy El Salvador’s strategy?

Absolutely. While you might not need 14 addresses, distributing your Bitcoin across multiple secure addresses reduces risk significantly. Consider your total holdings and create a distribution strategy that limits maximum loss per address.

How does this affect Bitcoin’s price and adoption?

El Salvador’s professional approach to Bitcoin security reinforces institutional confidence. When nations treat Bitcoin with traditional reserve asset security protocols, it legitimizes cryptocurrency as a store of value, potentially driving broader adoption and price stability.

To read more News about technology click here