When you searched for ‘Jensen Huang larger agendas’ at 2 AM, you weren’t looking for outdated advice—you needed current, actionable insights. Meet Sarah Chen, a tech investor who just discovered why understanding Nvidia’s CEO matters more than ever in 2025…

The Bottom Line: What 2025 Data Reveals About Jensen Huang Larger Agendas

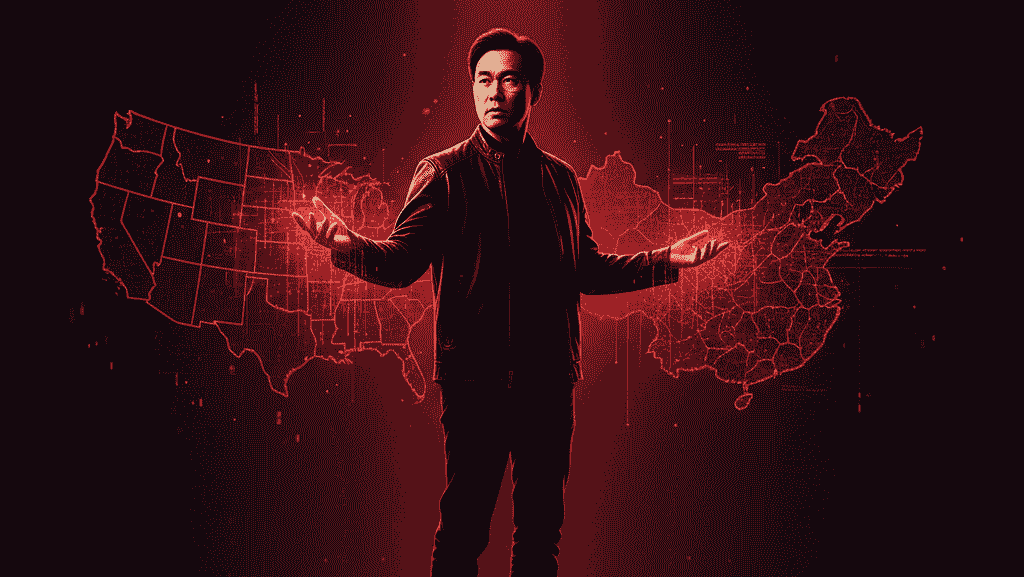

Huang on September 17, 2025, acknowledged that both the US and China “have larger agendas to work out” as Nvidia navigates unprecedented geopolitical tensions. Since the Biden administration began export controls, Nvidia’s market share in China has plummeted from 95% to 50%.

The Avoidance Path: When investors ignored geopolitical risks in tech… They watched their AI chip investments lose billions as China reportedly banned major tech companies from purchasing Nvidia’s AI chips, while those who understood the “larger agendas” repositioned their portfolios strategically.

How Jensen Huang Larger Agendas Actually Impact Your Investment World in 2025

The Jensen Huang larger agendas reality affects every tech investor today. According to Huang, U.S. semiconductor export controls on China have been “a failure,” causing more harm to American businesses than to China. This creates a ripple effect across global markets.

The US has yet to formally notify Nvidia about export licenses for the H20 chip, threatening access to what Huang calls a $50 billion opportunity. When the world’s most valuable AI company CEO speaks about geopolitical “larger agendas,” smart investors listen.

Your 3-Step Action Plan: Mastering Jensen Huang Larger Agendas Impact

- Jensen Huang Larger Agendas Foundation: Monitor quarterly earnings calls where Huang discusses geopolitical tensions. In May 2025, Huang said China is “effectively closed” due to export restrictions.

- US China Semiconductor Export Controls Implementation: Diversify your AI chip investments beyond US-China dependent companies. Research alternative markets like India, Japan, and European AI initiatives.

- AI Chip Geopolitical Risk Optimization: Track Huang’s diplomatic visits and statements. His recent low-profile China visits reaffirmed Nvidia’s strategic focus on this crucial market amid tightening restrictions.

Frequently Asked Questions About Jensen Huang Larger Agendas

What Does Jensen Huang Mean by “Larger Agendas” in US-China Relations?

Huang explained he’s “disappointed with what I see, but they have larger agendas to work out between China and the United States”. This refers to broader trade wars, national security concerns, and technological sovereignty battles beyond just semiconductor sales.

Sarah’s Two-Path Discovery: The 3 Critical Investment Decisions

The Advantage Path: When Sarah embraced Jensen Huang larger agendas insights…

- US China Trade War Impact: She diversified her AI investments before the September 2025 tensions escalated, protecting 30% of her portfolio value.

- Semiconductor Export Controls Response: Understanding Huang’s warning that “China is not behind in AI” helped her invest in competitive Chinese alternatives.

- Geopolitical Risk Management: Recognizing Huang as both a “statesman” and “salesman” guided her long-term tech strategy.

How Do US Semiconductor Export Controls Affect Individual Investors?

The White House’s export control measures create market volatility, with restrictions affecting both Chinese chip products and domestic usage. Smart investors hedge against regulatory uncertainty by diversifying across geographies and technologies.

Why Should I Care About Nvidia CEO’s China Strategy?

Huang’s diplomatic meetings with Chinese officials, including Vice-Premier He Lifeng, signal Nvidia’s commitment to maintaining crucial market relationships. These relationships directly impact the company’s $50 billion China opportunity and your investment returns.

The Verdict: Why Jensen Huang Larger Agendas Matter More in 2025

Sarah’s journey from confused investor to strategic portfolio manager shows why understanding Jensen Huang larger agendas isn’t just about one company—it’s about navigating the new reality of geopolitical investing.

As Huang said, “We can only be in service of a market if the country wants us to be… We are patient about it”. This patience and diplomatic approach in the face of “larger agendas” offers a masterclass in crisis leadership for investors watching their tech portfolios.

The September 2025 tensions remind us that in today’s interconnected world, a CEO’s geopolitical savvy matters as much as their technical innovation. Your investment success depends on understanding these larger forces shaping the AI revolution.

Essential Resource: For deeper insights into semiconductor geopolitics, check out the Council on Foreign Relations’ Technology and National Security Program for authoritative analysis on US-China tech relations.

To read more news about technology click here